FiBER: Finance and Behavioral Economics Research Center (under construction)

The field of Behavioral Economics was established in the 1970’s by two path-breaking researches of the two psychologists, Prof. Daniel Kahneman and Prof. Amos Tversky, who showed in a series of numerous experiments that consumer behavior is not always rational, as classical economic theory assumes. Yet, this behavior may be consistent and predictable. Since then, this field has been developing, diffusing almost to all fields in the Economics discipline in general, and in finance in particular. Not only does the expansion of research in this field take place in the academic world alone, but it also affects policy makers in different policies relating regulation, retirement pension savings, and household financial behavior.

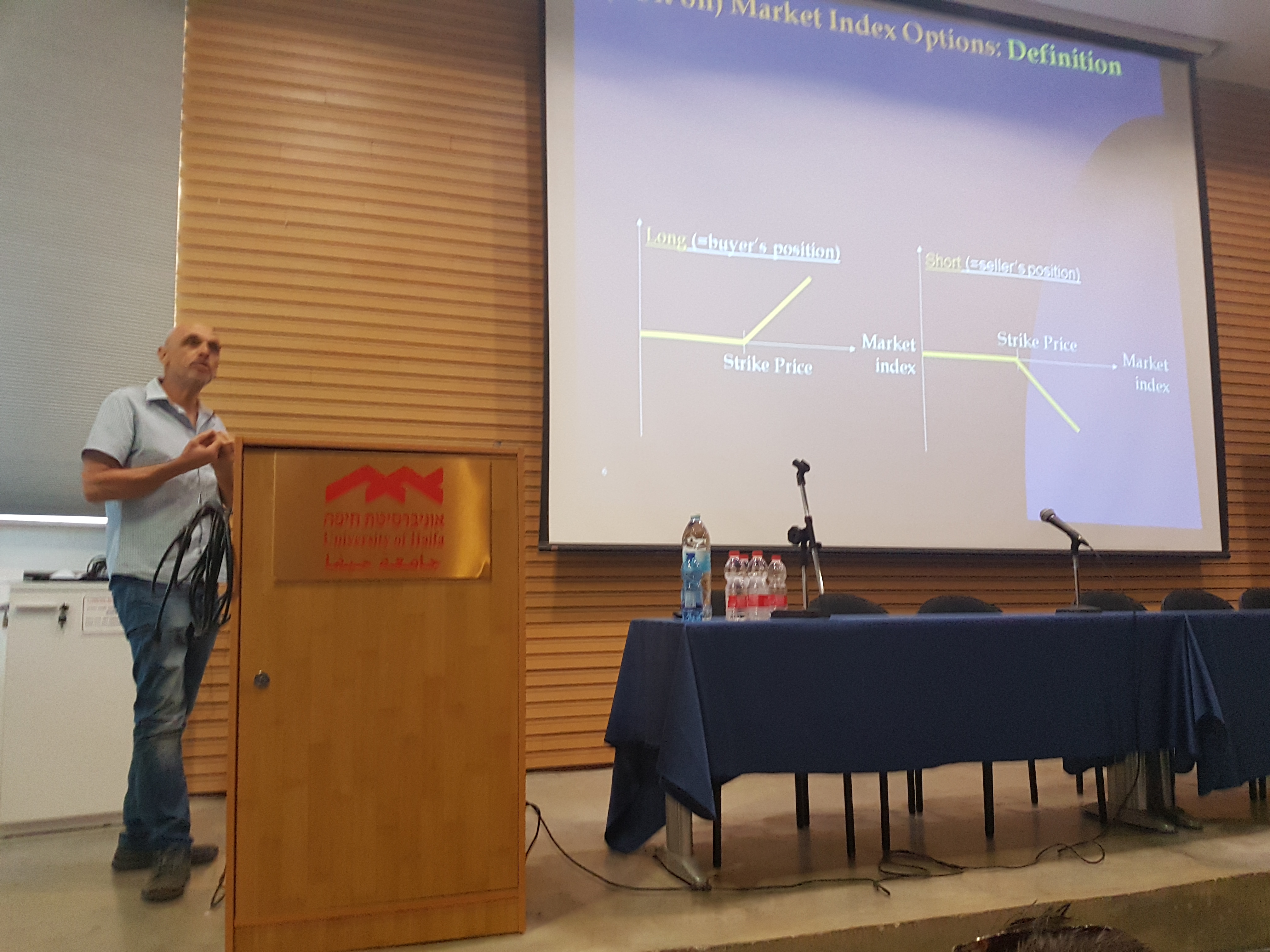

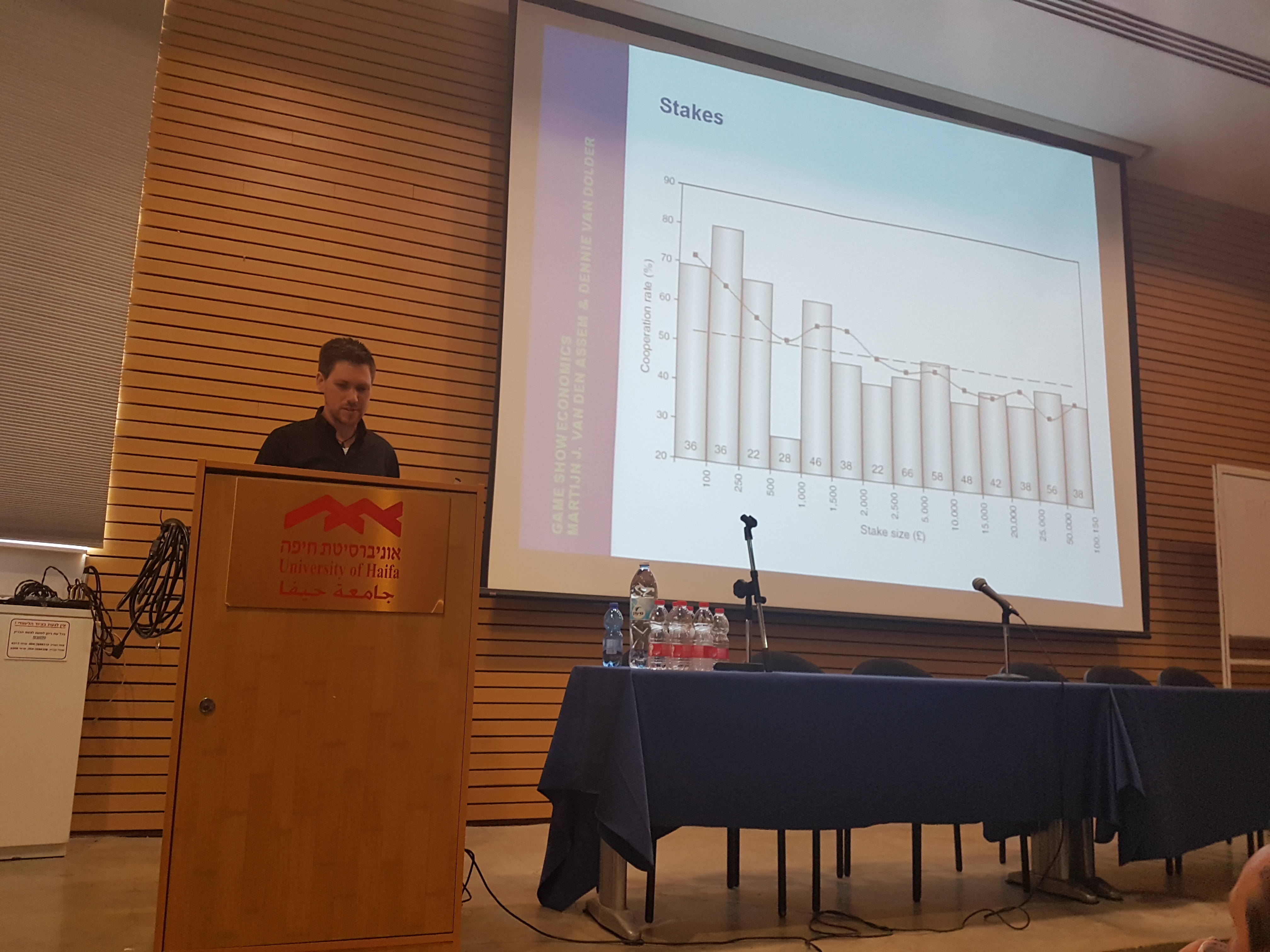

FiBER advances academic research in Behavioral Economics and decision making in financial markets with a focus on finance, including questions relating to trade, regulation, portfolio management, savings and the ability to work under simulation conditions based on real data. In addition, FiBER bridges the gap between academic research and policy makers, decision makers, consulting firms and investment firms.